Health Savings Account (HSA)

When you are enrolled in a Qualified High Deductible Health Plan (QHDHP) and meet the eligibility requirements, the IRS allows you to open and contribute to an HSA Account.

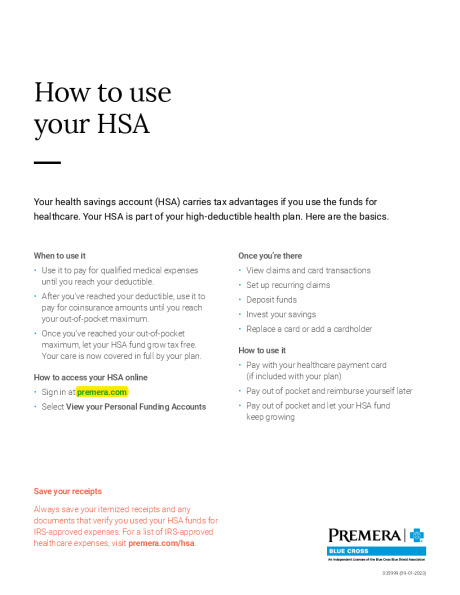

- Access your HSA account through your member portal at www.premera.com.

What is a Health Savings Account (HSA)?

An HSA is a tax-sheltered bank account that you own to pay for eligible health care expenses for you and/or your eligible dependents for current or future healthcare expenses. The Health Savings Account (HSA) is yours to keep, even if you change jobs or medical plans. There is no “use it or lose it” rule; your balance carries over year to year.

Plus, you get extra tax advantages with an HSA because:

- Money you deposit into an HSA is exempt from federal income taxes.

- Interest in your account grows tax free.

- You don’t pay income taxes on withdrawals used to pay for eligible health care expenses. (If you withdraw funds for non-eligible expenses, taxes and penalties apply).

- You also have a choice of investment options which earn competitive interest rates so your unused funds grow over time.

Are you eligible to open a Health Savings Account (HSA)?

Although everyone is able to enroll in the Qualified High Deductible Health Plan, not everyone is eligible to open and contribute to an HSA.

If you do not meet these requirements, you cannot open an HSA.

- You must be enrolled in a Qualified High Deductible Health Plan (QHDHP).

- You must not be covered by another non-QHDHP health plan, such as a spouse’s PPO plan.

- You are not enrolled in Medicare.

- You are not in the TRICARE or TRICARE for Life military benefits program.

- You have not received Veterans Administration (VA) benefits within the past three months.

- You are not claimed as a dependent on another person’s tax return.

- You are not covered by a traditional health care flexible spending account (FSA). This includes your spouse’s FSA. (Enrollment in a limited purpose health care FSA is allowed).

2026 HSA Contributions

You are able to contribute to your Health Savings Account on a pre-tax basis through payroll deductions up to the IRS statutory maximums.

The IRS has established the following maximum HSA contributions. Total contributions are made up of employer and employee combined deposits.

Maximums for the 2026 tax year:

- $4,400 Individual

- $8,750 Family

- If you are age 55 and over, you may contribute an extra $1,000 catch up contribution.

NWC 2026 Contribution:

-

$1,000* Self Only Coverage:

- $250 Initial (on 1/1/25 or enrollment date)

- $32.61 per remaining pay period

-

$2,000* Family Coverage:

- $500 Initial (on 1/1/25 or enrollment date)

- $65.22 per remaining pay period