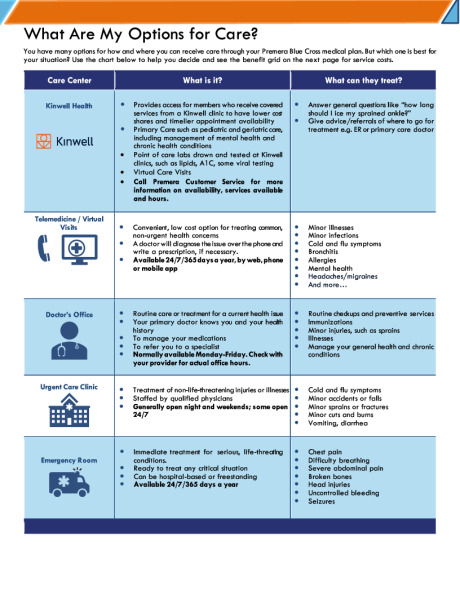

Which Medical Plan is Right?

Northwest Center offers you a choice of two medical plans with Premera Blue Cross, giving you the flexibility to select the plan that best fits your needs.

- To help control the cost of your care, this plan uses Premera’s Heritage network in Washington. When you see a preferred provider in the Heritage network, the amount you pay out of your pocket is lower than if you see an out-of-network provider.

- For care in Clark County and outside of Washington members can utilize contracted providers in the BlueCard program.

Medical Plan Comparison

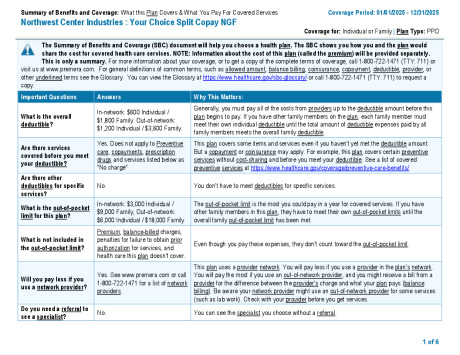

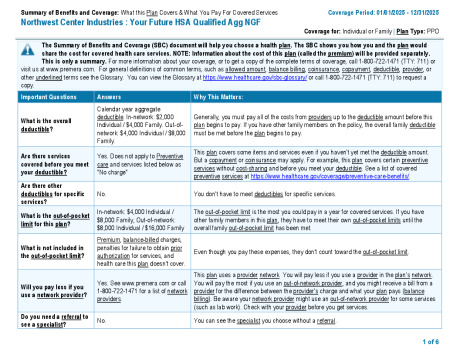

| | Health Savings Plan | Traditional Plan | ||||||

|---|---|---|---|---|---|---|---|---|

| In-Network Benefits |

Out-of-Network Benefits |

In-Network Benefits |

Out-of-Network Benefits | |||||

| Calendar Year Deductible* | ||||||||

Individual |

$2,000 | $4,000 | $600 | $1,200 | ||||

Family |

$4,000 (Shared) |

$8,000 (Shared) |

$1,800 | $3,600 | ||||

Coinsurance |

Plan Pays 80% |

Plan Pays 60% |

Plan Pays 80% |

Plan Pays 60% | ||||

|

Calendar Year Maximum Out-of-Pocket (Made up of deductible, coinsurance and copay expense) |

||||||||

Individual |

$4,000 | $8,000 | $3,000 | $6,000 | ||||

Family |

$8,000 | $16,000 | $9,000 | $18,000 | ||||

| Health Savings Account Calendar Year Contributions | ||||||||

Employer Contribution |

$1,000 Employee / $2,000 Family | N/A | ||||||

| Physician Office Visit | ||||||||

Primary Care |

80% | 60% | $25 copay (DW) |

60% | ||||

Specialty Care |

80% | 60% | $40 copay (DW) |

60% | ||||

| Preventive Care | ||||||||

Preventive Exams |

100% (DW) | Not Covered | 100% (DW) | Not Covered | ||||

| Diagnostic Services | ||||||||

X-ray and Lab Tests |

80% | 60% | 80% (DW) |

60% | ||||

Complex Radiology |

80% | 60% | 80% (DW) |

60% | ||||

Urgent Care (Stand Alone) |

80% | 60% | $40 copay (DW) |

60% | ||||

Emergency Room |

80% | 80% | ||||||

Inpatient Facility Charges |

80% | 60% | 80% | 60% | ||||

| Mental Health & Substance Abuse | ||||||||

Inpatient |

80% | 60% | 80% | 60% | ||||

Outpatient |

80% | 60% | $25 copay (DW) |

60% | ||||

| Other Services | ||||||||

Chiropractic, Acupuncture 12 visits PCY** |

80% | 60% | $25 copay (DW) |

60% | ||||

| Rehabilitation Services | ||||||||

Inpatient – 30 days PCY* |

80% | 60% | 80% | 60% | ||||

Outpatient – 45 visits PCY* |

80% | 60% | $40 copay (DW) |

60% | ||||

Note:

*PCY = Per Calendar Year

**Deductible applies unless indicated with a (DW) = Deductible Waived

*** The deductible on the Health Savings Plan is shared. When at least one dependent is enrolled, the overall deductible must be met before the plan pays at the coinsurance level.

PLANselect Tool

We have a plan comparison tool that will help you compare the cost of the Traditional Plan and Health Savings Plan based on who you are covering and your upcoming medical and prescription drug needs. It will only take 5 minutes to get your results!

Find an In-Network PPO Provider

- Visit www.premera.com

- Click on “For Members” on the right hand side of the webpage

- Click on “Find a Doctor” at the top of the webpage

- Enter your zip code or address

- Select the Heritage Network and the type of provider you are looking for.

Virtual Care Options for Premera Members

Premera MyCare App

Don’t wait to feel better. Through the Premera MyCare app, you can be seen virtually right now.

Scan the code to download the MyCare app.